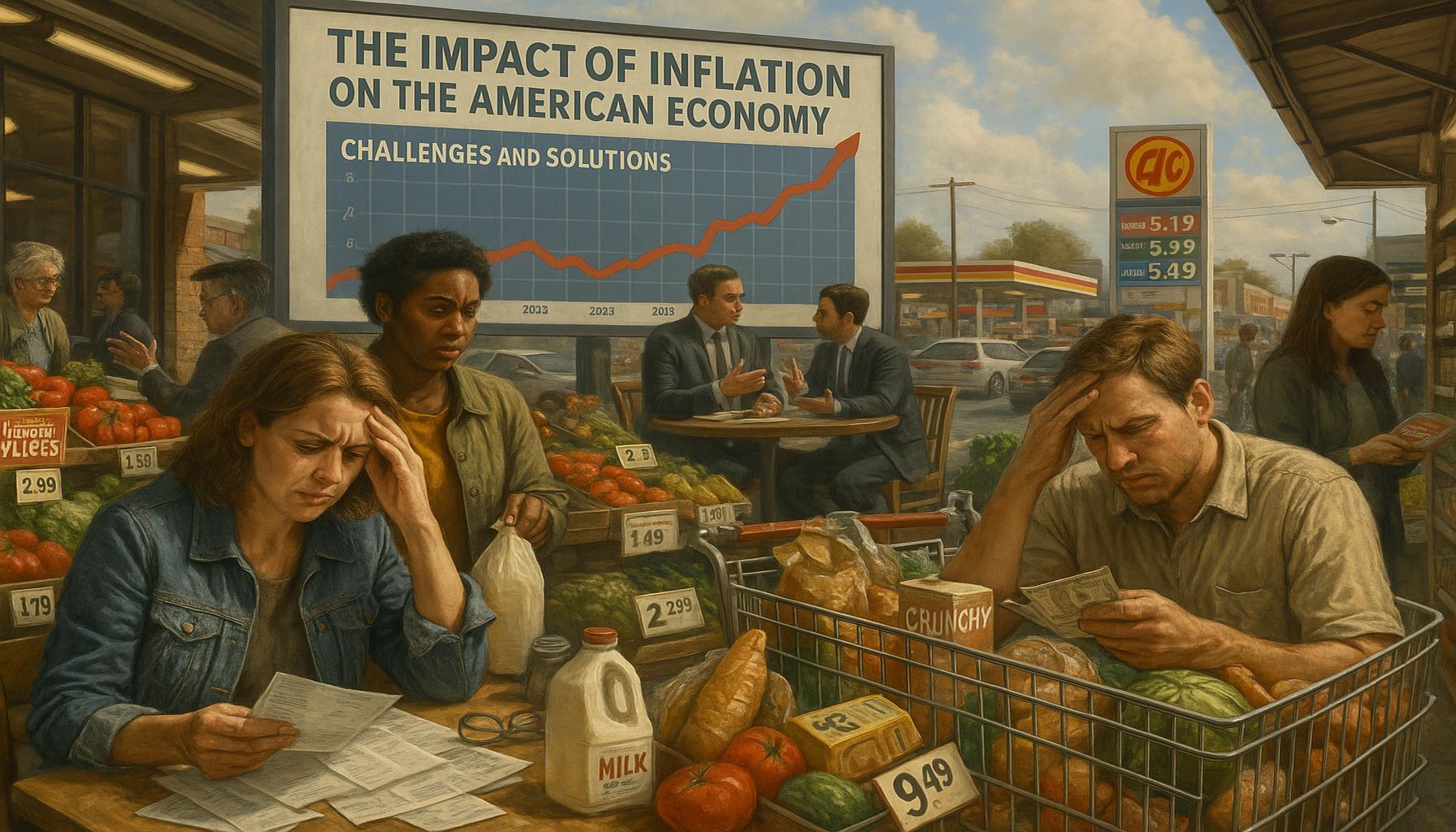

The impact of inflation on the American economy: challenges and solutions

Understanding Inflation’s Multifaceted Effects on the Economy

Inflation, as an essential economic indicator, serves as a barometer for the health of the American economy. Its ripple effects touch every segment of society—from everyday consumers to large-scale businesses and the policymakers tasked with guiding monetary policy. As inflation persists, it brings forth significant challenges that can alter the trajectory of economic growth and stability.

Key Effects of Inflation

- Purchasing Power Decrease: One of the most immediate effects of inflation is the diminishing value of the dollar. For example, if the inflation rate is at 3%, a $1,000 paycheck would only maintain purchasing power equivalent to approximately $970 from the previous year. This erosion of purchasing power makes essential goods more expensive, leading consumers to reconsider their spending habits.

- Cost of Living Increase: As prices rise, households find themselves devoting a larger portion of their budgets to necessities—food, housing, and healthcare. A recent report indicated that U.S. rent prices surged by 15% in some urban areas over the last year, forcing families to search for additional income sources or downsize. Such financial strain can lead to increased anxiety and reduced quality of life.

- Interest Rate Adjustments: In response to mounting inflation, central banks like the Federal Reserve often increase interest rates to cool off the economy. While this can stabilize prices, it may also slow economic growth by making borrowing more expensive for individuals and businesses. For instance, higher mortgage rates can dampen the housing market, leading to decreased construction and fewer jobs in associated industries.

Challenges Arising from Inflation

The repercussions of inflation are complex and multifaceted, leading to various challenges within the economy. For instance, consumer confidence often wanes when prices rise unexpectedly, which in turn can create a negative feedback loop that suppresses spending and investment. Furthermore, businesses may face increased costs for materials and labor, necessitating tough decisions such as layoffs or scaling back on expansion plans.

Disparities in inflation’s impact can be stark; lower-income families often experience a greater percentage loss in purchasing power compared to wealthier households due to their higher reliance on basic goods. This divergence can exacerbate social inequalities, prompting calls for structural changes in economic policy.

Potential Solutions to Combat Inflation

To mitigate the adverse effects of inflation, a variety of potential solutions should be considered:

- Monetary policy adjustments by the Federal Reserve are crucial in managing inflation rates. This could include strategic interest rate hikes designed to stabilize the economy without inducing recession.

- Fiscal measures aimed at supporting vulnerable populations, such as enhanced social safety nets or direct financial aid, can help alleviate the financial pressures faced by those most affected by rising costs.

- Strategies for businesses must also be developed, enabling them to manage increased operational costs without resorting to layoffs or decreased investment in workers’ development. This could involve adopting more efficient technologies or consolidating supply chains to reduce expenses.

Ultimately, a thorough examination of these dynamics is essential for fostering resilience in the American economy amidst ongoing inflationary pressures. By addressing the multifaceted impacts of inflation with careful analysis and targeted solutions, policymakers and businesses can work towards a more stable economic future.

Inflation’s Ripple Effects: Examining the American Economic Landscape

The persistent rise in inflation in the United States has led to a nuanced understanding of its broader economic implications. With inflation rates hovering around 8% in recent years, the American populace is feeling the strain across various sectors, leading to concerns regarding sustainability and growth. The multifaceted nature of inflation creates an intricate web of challenges, demanding comprehensive responses from both policymakers and businesses.

The Dynamics of Inflation: A Closer Look

To comprehend the implications of rising inflation, one must first appreciate the factors driving it. Historical data illustrates that inflation often correlates with increased demand in the economy, particularly during recovery periods. However, the recent inflation surge has also been influenced by supply chain disruptions, commodity price shocks, and expansive fiscal policies adopted during the COVID-19 pandemic. As a result, prices for key consumer goods have surged, effectively reshaping the economic landscape.

For instance, a recent survey conducted by the Bureau of Labor Statistics (BLS) revealed that consumer prices rose significantly across various categories, including energy (28.8%), food (10.1%), and transportation services (14.6%) over the past year. These increases starkly contrast with wage growth, which has struggled to keep pace, leading to a decline in real wages for many households. This disconnect between wage growth and inflation underscores the growing urgency for policy intervention.

Sowing Seeds of Inequality: The Disproportionate Impact of Inflation

- Lower-Income Families: Inflation disproportionately affects lower-income households, who spend a larger percentage of their income on essential goods and services. The rising costs of food and housing place significant financial strain on these families, pushing many into a cycle of poverty.

- Fixed-Income Vulnerability: Retirees and individuals reliant on fixed-income sources, such as pensions or social security, face heightened risks during inflationary periods. Their purchasing power erodes as prices rise, without any corresponding increase in their income, further exacerbating their economic vulnerability.

- Regional Disparities: Inflation impacts also vary geographically. Urban centers often experience sharper price increases, leading to a crisis for working-class families, while rural areas may not feel the effects as acutely. Nevertheless, inflation creates a complex landscape of economic disparities that policymakers must navigate.

Business Responses: Navigating Increasing Costs

For businesses, the inflationary environment presents a dual-edged sword. On one hand, rising prices can enhance revenue in the short term, but on the other hand, if employees demand higher wages to match the cost of living, profit margins may be squeezed. To navigate this turbulent terrain, companies are increasingly adopting a variety of strategies:

- Cost-Pass-Through: Some firms may choose to pass on increased costs to consumers through price hikes. However, this can lead to decreased demand if customers are unwilling or unable to absorb the higher prices.

- Operational Efficiency: Businesses are exploring automation and efficiency improvements to maintain productivity without incurring additional labor costs. Investing in technology may indeed offer a long-term solution to the challenges posed by inflation.

- Flexible Pricing Models: Companies are reevaluating their pricing models to adapt to the fluctuating cost environment, with some experimenting with dynamic pricing strategies aimed at better aligning with market conditions.

As the American economy grapples with the challenges posed by inflation, it becomes increasingly apparent that a collaborative approach—integrating insights from economic research, business strategy, and social welfare considerations—will be essential in crafting effective and equitable solutions.

Navigating the Future: Policy Interventions and Economic Readjustments

The ongoing inflationary challenges in the American economy necessitate multifaceted policy interventions and strategic economic adjustments to mitigate the adverse impacts felt by households and businesses alike. A keen evaluation of potential solutions not only reveals the gaps in current strategies but also highlights forward-thinking approaches essential for future resilience.

Monetary Policy: The Role of the Federal Reserve

One of the primary tools available for combating inflation is through monetary policy adjustments, particularly by the Federal Reserve. Traditionally, the Fed has responded to rising inflation by increasing interest rates, a tactic designed to curtail borrowing and dampen consumer spending. For instance, during the late 1970s and early 1980s, the Fed raised interest rates significantly, with the federal funds rate peaking at over 20% in an effort to rein in hyperinflation.

However, raising rates also has a downside, particularly in the current economic climate. Higher interest rates can lead to increased costs for loans, eroding consumer buying power and slowing down business investment. A recent analysis from the Federal Reserve Bank of St. Louis emphasizes that while rate hikes can suppress inflation, they also heighten the risk of recession if executed too aggressively. Finding a balance between controlling inflation and fostering economic growth is essential, demonstrating the intricacy of central bank decisions.

Fiscal Policy: Targeted Support and Investments

In conjunction with monetary policy, fiscal measures can play a crucial role in alleviating the burdens of inflation, particularly for vulnerable populations. The federal government has various levers to pull, including tax rebates or direct cash payments aimed at households most affected by soaring prices. Such measures can enhance purchasing power and stimulate consumer spending, creating a buffer against inflation’s effects. For example, the provisions made during the American Rescue Plan, which distributed stimulus checks to millions of citizens, provided immediate financial relief but also complicated inflation dynamics.

Further investments in infrastructure and public services can address long-term inflationary pressures by improving supply chains and productivity across the economy. The Biden Administration’s Infrastructure Investment and Jobs Act, which aims to enhance transportation networks and broadband access, emphasizes the dual benefit of fostering immediate job creation while setting the stage for improved efficiency and lower costs in the long run.

Market Adaptations: Embracing Innovation and Local Responses

In the face of inflation, both businesses and consumers can adapt through innovative strategies and local initiatives. For instance, businesses are increasingly adopting sustainable practices that not only reduce costs but also respond to growing consumer demand for environmentally friendly products. Even amidst rising prices, companies that focus on sustainability can expect increased consumer loyalty, carving out a competitive advantage.

Moreover, local supply chains can buffer the impacts of global disruptions, as recent events have revealed vulnerabilities associated with global sourcing. Communities that prioritize local sourcing reduce currency fluctuation risks and enhance economic resilience. A study by the Institute for Local Self-Reliance highlights that local businesses typically reinvest a significant portion of revenues back into their communities, which can help bolster economic stability during inflationary periods.

The Long-Term View: Education and Financial Literacy

Lastly, enhancing financial literacy among consumers is an underappreciated yet vital strategy for addressing the challenges posed by inflation. By empowering individuals with knowledge regarding personal finance, budgeting, and investment strategies, households can make informed decisions that help them weather inflation storms more effectively. Programs that advocate for financial education can mitigate some of the adverse impacts associated with rising prices, fostering greater economic security.

As inflation persists as a significant feature of the American economic landscape, the interplay of monetary policy, fiscal measures, market adaptations, and financial literacy will be crucial in navigating these choppy waters. A coordinated response that balances immediate relief with long-term strategic initiatives is essential for fostering a more robust and equitable economy.

Conclusion: Building a Resilient Economic Framework

The pervasive impact of inflation on the American economy presents a series of challenges that require concerted efforts and a robust framework for resolution. As explored in this article, the rising cost of living affects not just individual households, but broad sectors of the economy, pressing policymakers to act promptly and effectively. Monetary and fiscal interventions must be finely tuned to balance controlling inflation while stimulating growth to prevent recessionary spirals that could exacerbate financial hardships.

Moreover, fostering economic adaptations through local sourcing and market innovations can create a resilient landscape, promoting sustainability while also addressing supply chain vulnerabilities. As businesses pivot towards eco-conscious practices, they pave the way for a deeper connection with consumers, demonstrating that even in times of increased costs, a focus on sustainability can lead to lasting loyalty and improved financial outcomes.

Equally important is the push for enhanced financial literacy among consumers, empowering individuals to make judicious financial choices, ultimately fostering a more secure financial future. Programs aimed at educating citizens will be instrumental in equipping them to navigate the complexities of inflation and its effects on everyday life.

In summary, while inflation poses significant challenges to the American economy, the pathways to solutions lie in targeted policies, innovative market strategies, and educational initiatives. By embracing these opportunities for adaptation and improvement, the United States can cultivate economic resilience and sustainability, ultimately minimizing the adverse impacts of inflation for all its citizens.

James Carter is a financial writer and consultant with expertise in economics, personal finance, and investment strategies. With years of experience helping individuals and businesses navigate complex financial decisions, James provides practical insights and analysis. His goal is to empower readers with the knowledge they need to achieve financial success.